What Medical Expenses Are Deductible In Nj . Web qualified medical expenses are medical expenses: Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. That are allowed for federal income tax purposes; Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income.

from www.pdffiller.com

Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income. Web qualified medical expenses are medical expenses: That are allowed for federal income tax purposes; Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a.

Fillable Online 20 Medical Expenses You Didn't Know You Could Deduct

What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web qualified medical expenses are medical expenses: That are allowed for federal income tax purposes; Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break.

From www.taxo.ca

What medical expenses are tax deductible? Taxo What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web qualified medical expenses are medical expenses: That are allowed for federal income tax purposes; Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web new jersey law provides several. What Medical Expenses Are Deductible In Nj.

From www.pdffiller.com

Fillable Online 20 Medical Expenses You Didn't Know You Could Deduct What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. That are allowed for federal income tax purposes; Web new jersey allows you to deduct from your gross. What Medical Expenses Are Deductible In Nj.

From www.pinterest.com

5 Ways to Cover Costs When You Can’t Afford Your Insurance Deductible What Medical Expenses Are Deductible In Nj That are allowed for federal income tax purposes; Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%,. What Medical Expenses Are Deductible In Nj.

From pioneerinstitute.org

Insurer Using Market Clout to Lower Healthcare Costs for Consumers What Medical Expenses Are Deductible In Nj Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey law provides several gross income tax deductions that can be taken. What Medical Expenses Are Deductible In Nj.

From www.pinterest.com

Medical Expenses You Can Deduct From Your Taxes Medical, Tax time What Medical Expenses Are Deductible In Nj Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during. What Medical Expenses Are Deductible In Nj.

From www.pinterest.com

Tax Deduction Worksheet Small business tax, Small business tax What Medical Expenses Are Deductible In Nj Web qualified medical expenses are medical expenses: Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. That are allowed for federal income tax purposes; Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web medical expenses, including medical insurance. What Medical Expenses Are Deductible In Nj.

From www.pinterest.com

a blue poster with the words common deductible business expenies on it What Medical Expenses Are Deductible In Nj Web qualified medical expenses are medical expenses: Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web however, if your nj wages were not reduced by the contribution than you. What Medical Expenses Are Deductible In Nj.

From www.dreamstime.com

CoPay Deductible Payment Your Share Obligation Medical Insuranc Stock What Medical Expenses Are Deductible In Nj Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web qualified medical expenses are medical expenses: Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web new jersey law provides several gross income tax deductions that can be taken on the. What Medical Expenses Are Deductible In Nj.

From www.endeavourwealth.ca

Make Your Health Expenses Deductible to your Business What Medical Expenses Are Deductible In Nj Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new. What Medical Expenses Are Deductible In Nj.

From orientacionfamiliar.grupobolivar.com

Uf Health Insurance Cost Life Insurance Quotes What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income. That are allowed for federal income tax purposes; Web in new jersey, for example, the agi threshold for deducting. What Medical Expenses Are Deductible In Nj.

From classwinford.z19.web.core.windows.net

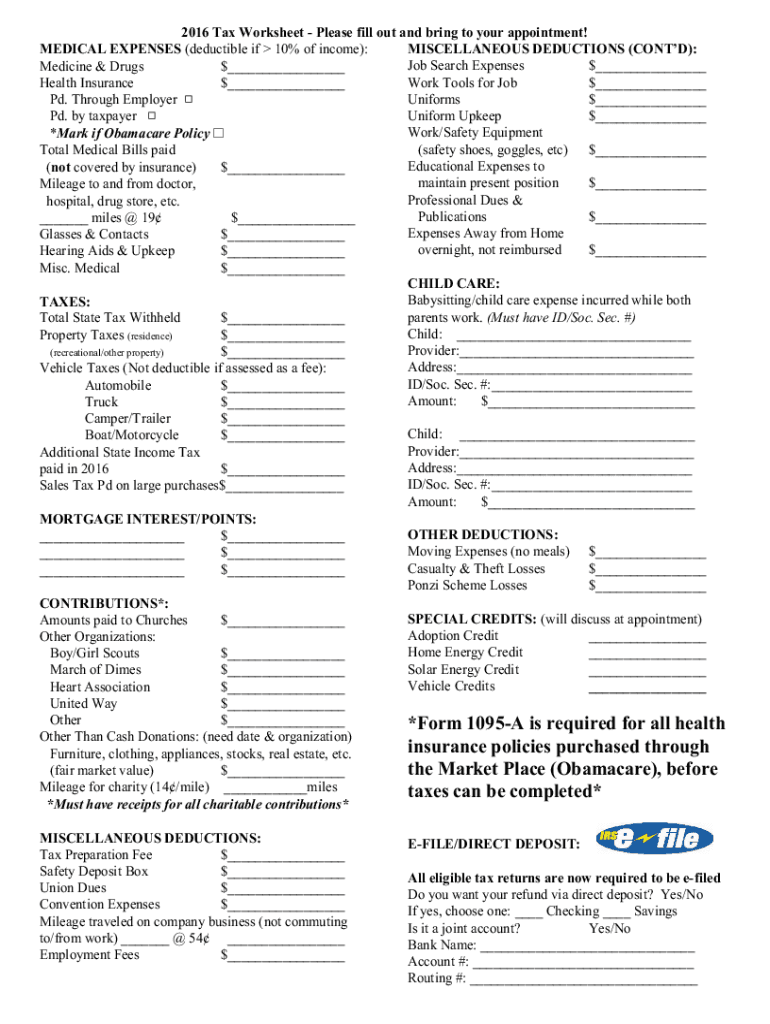

Simple Tax Preparation Worksheet What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income. Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the.. What Medical Expenses Are Deductible In Nj.

From www.pinterest.com

Do you have a lot of medical expenses in the US? Learn how to deduct What Medical Expenses Are Deductible In Nj Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web however, if your nj wages were not reduced by the contribution than you may deduct the. What Medical Expenses Are Deductible In Nj.

From www.goodrx.com

7 Surprising Medical Expenses That Are Tax Deductible GoodRx What Medical Expenses Are Deductible In Nj Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. Web new jersey law provides several gross income tax deductions that can be taken on the. What Medical Expenses Are Deductible In Nj.

From dodiqmarabel.pages.dev

What Is Medicare Part D Deductible For 2024 Sacha Zahara What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web new jersey law provides several gross income tax deductions that can be taken on the new jersey income. That are allowed for federal income tax purposes; Web in new jersey, for example, the agi threshold for deducting. What Medical Expenses Are Deductible In Nj.

From www.dochub.com

Medical expenses tax deductible Fill out & sign online DocHub What Medical Expenses Are Deductible In Nj Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. That are allowed for federal income tax purposes; Web medical expenses, including medical insurance premiums, are deductible on your federal tax return to the extent. Web qualified medical expenses are medical expenses: Web however, if your nj wages. What Medical Expenses Are Deductible In Nj.

From www.seilersingleton.com

Are you able to deduct medical expenses on your tax return? Seiler What Medical Expenses Are Deductible In Nj Web however, if your nj wages were not reduced by the contribution than you may deduct the contribution as a. That are allowed for federal income tax purposes; Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web new jersey allows you to deduct from. What Medical Expenses Are Deductible In Nj.

From db-excel.com

X Organizer Worksheet Premium Deduction Checklist For — What Medical Expenses Are Deductible In Nj That are allowed for federal income tax purposes; Web on your new jersey tax return you can deduct medical expenses in excess of 2% of your new jersey gross income. Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. Web qualified medical expenses are medical. What Medical Expenses Are Deductible In Nj.

From www.chegg.com

Solved 18) Which of the following costs are deductible as an What Medical Expenses Are Deductible In Nj Web in new jersey, for example, the agi threshold for deducting medical expenses is just 2%, which means taxpayers there might get a break. That are allowed for federal income tax purposes; Web new jersey allows you to deduct from your gross income certain medical expenses that you paid during the. Web qualified medical expenses are medical expenses: Web however,. What Medical Expenses Are Deductible In Nj.